Shall we call you?

Entiende tu hipoteca con Wypo

Si no tienes claro qué hipoteca es la que más te conviene, queremos que sepas que ¡es normal! Comprar una vivienda y pedir una hipoteca es probablemente la mayor inversion de tu vida y, además, cada uno tenemos unas circunstancias particulares que hacen que la que es la mejor hipoteca para ti no tenga por qué serla para otros. ¡No existe una 'mejor hipoteca' universal!

Y entonces, ¿cómo puedes saber cual es la que más se adapta a ti? Te damos algunos tips para que sepas en qué cosas fijarte a la hora de elegir tu hipoteca.

DO YOU WANT TO MAKE ENDS MEET?

Note the TIN

Este valor tiene una relación directa con la cuota que pagas mes a mes. Eso sí, luego también hay que prestar atención a si es de tipo fijo o variable.

YOU DON'T WANT TO PAY EVEN 1 CENT. MORE THAN NECESSARY TO THE BANK?

Look at the TAE

Este valor es muy importante para entender cómo repercuten las comisiones y bonificaciones (seguro de vida, seguro de hogar...). Pero ojo, la hipoteca con el TAE más alto, ¡no tiene por qué ser peor opción! Depende del conjunto de la oferta. quizá esa oferta con el TAE más alto sea la que te da mayor plazo para devolver el dinero.

DO YOU LIKE TO BE IN CONTROL OF YOUR SPENDING?

Note the FIXED TYPES

It is not usually the cheapest fee. But it is the way to sleep peacefully during all the nights of your mortgage.

ARE YOU YOUNG AND THIS IS YOUR FIRST HOME?

Note the VARIABLE TYPES

Los tipos variables hoy en día ofrecen cuotas más bajas que los tipos fijos. Además, podrás pasar de variable a fijo cuando quieras y posiblemente tu situación económica mejore en el futuro y optes por cuotas más altas pero la seguridad de saber que siempre pagarás lo mismo.

Y si ya estás preparado...

¡comenzamos!

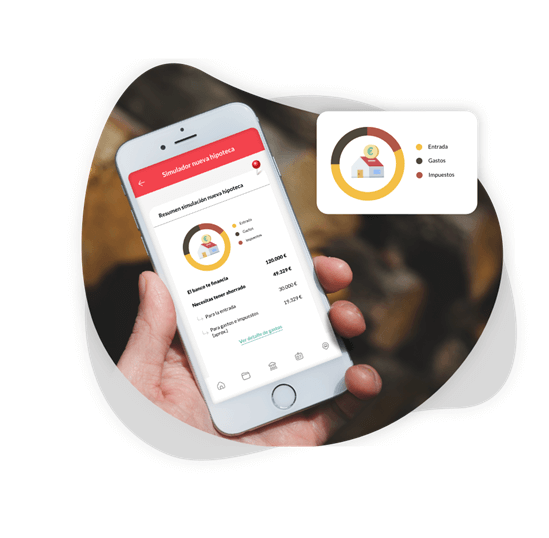

With our mortgage simulator you can calculate in an instant (and in a secure environment) your mortgage payments based on your personal needs.

Also, you can run, save and retrieve as many simulations as you want. Name them and so you will have them perfectly identified.

And the best thing: tinker as much as you want without fear. You won't break anything!