Understand your mortgage with Wypo

If you are not sure which mortgage is the best for you, we want you to know that it is normal! Buying a home and requesting a mortgage is probably the biggest investment of your life and, furthermore, each one of us has particular circumstances that mean that what is the best mortgage for you does not have to be the best mortgage for others. There is no universal 'best mortgage'!

And then, how can you know which is the one that best suits you? We give you some tips so that you know what to look for when choosing your mortgage.

DO YOU WANT TO GET BAGGY AT THE END OF THE MONTH?

Note the TIN

This value is directly related to the fee you pay each month. Of course, then you also have to pay attention to whether it is of a fixed or variable rate.

YOU DON'T WANT TO PAY EVEN 1 CENT. MORE THAN NECESSARY TO THE BANK?

Look at the TAE

This value is very important to understand how commissions and bonuses affect (life insurance, home insurance...). But beware, the mortgage with the highest APR does not have to be a worse option! It depends on the offer set. Perhaps that offer with the highest APR is the one that gives you the longest term to return the money.

DO YOU LIKE TO BE IN CONTROL OF YOUR SPENDING?

Note the FIXED TYPES

It is not usually the cheapest fee. But it is the way to sleep peacefully during all the nights of your mortgage.

ARE YOU YOUNG AND IS IT YOUR FIRST HOME?

Note the VARIABLE TYPES

Variable rates today offer lower fees than fixed rates. In addition, you will be able to go from variable to fixed whenever you want and possibly your economic situation will improve in the future, and you will opt for higher installments but the security of knowing that you will always pay the same.

And if you're ready...

Let's get started!

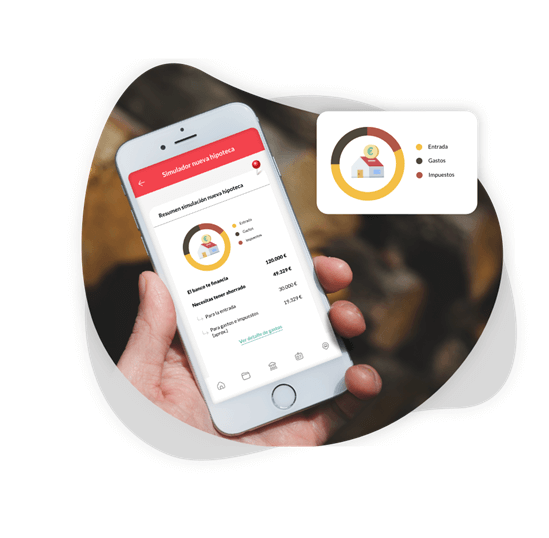

Con nuestro simulador de hipotecas puedes calcular en un momento (y en un entorno seguro) las cuotas de tu hipoteca en función de tus necesidades personales.

Also, you can run, save and retrieve as many simulations as you want. Name them and so you will have them perfectly identified.

And the best thing: tinker as much as you want without fear. You won't break anything!